Following are answers to the most Frequently Asked Questions first time home buyers have

about mortgages. If your question is not here, call 905-795-1637 to talk

to an OECU Mortgage Advisor or email support@oecu.on.ca.

We’ll help you arrange a mortgage that suits your financial situation and minimizes total interest costs. Assistance includes:

The first time Home Buyer's Plan (HBP) enables RRSP withdrawals up to $25,000 ($50,000 for a couple) to help make the

down payment. Withdrawals must be repaid within 15 years. RRSP funds must be on deposit for at least 90 days. Other

conditions apply.

Tip: If you have non-registered down payment savings of, say, $10,000 and have enough RRSP “contribution room”, transfer

the $10,000 into a RRSP at least 90 days before your closing date. Then withdraw the down payment money from your RRSP.

The advantage? Your $10,000 RRSP contribution is tax deductable and you can use any tax refund to repay the RRSP

withdrawal or cover other home expenses. Note that RRSP withdrawals may mean foregoing tax-sheltered investment

growth.

What you pay each month will depend on the amount your borrow, the interest rate, your mortage term and your payment

schedule. Use our simple mortgage payment calculator to determine what’s affordable for you. Check out our posted rates

here. We offer weekly, biweekly and monthly payment options set up through payroll deduction for your convenience.

2) Free, no-obligation information and advice about the home buying process

3) Advice about structuring your mortgage features to minimize interest costs

1) A single point of contact for your mortgage inquiries

How can my OECU Mortgage Advisor help me?

What will my monthly payments be?

Why should I get a pre-approved mortgage before I look for a home?

Mortgage pre-approval will:

1) Calculate how much you can affordably borrow

2) Guarantee a fixed interest rate for 90-days, even if rates rise

3) Enable you to act quickly when it’s time to make an offer

4) Identify up front closing costs in addition to the down payment

Start your pre-approval online - we’ll be in touch within 24 hours.

What is a mortgage down payment?

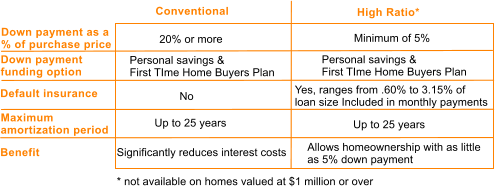

The down payment is the portion of your purchase price that you pay upfront yourself. There are conventional and high

ratio mortgages - with high ratio requiring default insurance as follows:

Can I use my RRSP as a down payment?

What’s the difference between the mortgage amortization period and the mortgage term?

Amortization Period: Number of years (typically 25) to fully repay the loan assuming a constant interest rate and payment.

Shorter amortization periods reduce total interest costs. Longer amortization periods lower monthly payments but increase

interest costs over time. Amortization is broken out into a series of terms…..

What’s the difference between a fixed rate and variable rate mortgage?

Fixed Rate

Variable Rate

Difference

Interest Rates

Attractive if...

What’s the difference between a closed and open term mortgage?

Is a short or longer term mortgage better for me?

Besides the down payment, what are other up-front costs associated with buying a house?

What type of mortgage is right for my situation?

This largely depends on your current & projected financial situation...

This depends on your credit history and Total Debt Service Ratio (TDS). TDS is the maximum % of gross monthly household

income needed to pay fixed monthly mortgage payments, property taxes, heating costs and other costs (e.g. credit cards,

loans, 50% of condo fees, etc.). Use our “How much home can I afford?” calculator. Check out our posted rates here.

Gross monthly household income $8,000

Monthly mortgage payments/property taxes/heat/

condo fees/other fixed expenses $2,800

TDS Ratio 35%

How much home can I afford?

TDS Example:

What documents will I need to provide for the pre-approval?

You should have the following available:

Social insurance number

Current address

Previous address (if less than 3 years at current address)

Current employer (name, address, telephone no.)

Previous employer (if with current employer less than 3 years)

Sources of verifiable income (e.g. letters of employment)

If self-employed, income tax ‘Notice of Assessment’ for last 2 years

Bank statement confirming payroll deduction

Investment statement

What are the key steps in buying a house?

Calculate how much home you comfortably qualify for. Tip: maximize the down payment to reduce interest

costs (ideally, 20% or more of purchase price).

Step 1

Arrange an OECU loan pre-approval to know what you can afford

Step 2

Choose an appropriate mortgage type (i.e. fixed or variable rate, open or closed, short or long term) based on

your situation.

Step 3

On closing day...

OECU provides the mortgage funds to your lawyer

You provide the down payment less the deposit to your lawyer plus any property tax and prepaid utility adjustments

Lawyer pays the previous owner, registers the home in your name and gives you the deed and keys to your home

.

.

.

Step 4

Your Situation

Mortgage Types

Information

Want fixed rate and monthly

payments over the mortgage

term for budgeting and

peace of mind

Closed, Fixed Rate

(most common)

Open, Fixed Rate

Want to take advantage of a

declining prime rate

scenario to pay down

mortgage faster

Open, Variable Rate

Is the lowest interest rate always the best deal?

The best mortgage involves a competitive interest rate and ‘flexibility’ that saves you the most amount of money long-term.

Statistics show that over half of Canadians with a mortgage renegotiate before their term end due to a change in prime rate

or personal financial conditions. The average five-year borrower changes their mortgage every 3 1/2 years.

If you obtain a cheap rate and want/need to refinance before term end, you may be subject to severe financial penalties

due to mortgage restrictions. That’s why flexibility (e.g. pre-payment privileges, portability, hybrids, refinancing) easily

outweighs small (e.g. 0.10 to 0.25%) differences in interest rates. The lowest rate saves hundreds of dollars up front but

may cost thousands after closing.

Your OECU mortgage advisor will explain your flexibility options and help arrange the best deal to suit your short and

Closing costs are typically in the 2% range of the loan amount. They include property appraisal, home inspection, legal fees

and disbursements, land transfer tax, title insurance and any prepaid property tax and utility adjustments. So, if your new

home is $300,000, closing costs could be $6,000. Besides closing costs, other expenses typically include moving costs,

furniture, appliances, etc. Your OECU mortgage advisor will help you identify these costs.

Mortgage Term: Contracted length of time the loan interest rate is guaranteed. At expiry, the contract is renewed for another

term at the prevailing interest rate until fully amortized. Contract terms are either short or longer as follows...

Short Term Open

Long Term

Term period

Attractive if...

From 6 months to 2 years

Interest rates projected to fall

From 3 to 5 years

Interest rates projected to rise

Fixed interest rate and monthly

payments over term

Fluctuating rates and fixed

monthly payments over term

Higher than variable rate

Lower than fixed rate

Prime rate is rising

Risk adverse - prefer fixed

payments for peace of mind

.

.

Prime rate is stable or falling

Risk tolerant &/or expecting

cash inflow soon to pay down

all or part of the mortgage

.

.

Firstly, any capital prepayment privileges amortize a mortgage faster since all pre-payments are applied directly to capital.

Closed mortgages typically allow annual capital pre-payments up to 20% of the original mortgage or higher monthly

payments without penalty. Interest rates for closed term mortgages are generally lower than for open term mortgages

Open mortgages allow full capital pre-payments or a total discharge anytime without penalty. They may be appealing if

you are planning to pay off your mortgage in the near future via an inheritance, bonus, etc. Interest rates are generally

higher versus closed mortgages because of the pre-payment flexibility.

A shorter term is more viable if selling your home in the near future to pay off your mortgage, or in a declining rate scenario

by the time your term expires.

A longer-term mortgage of 3 to 5 years is more viable in a stable or rising rate scenario. It also provides easier budgeting

and peace of mind benefits.

Fixed interest rate and payments over term. Early

repayment penalities may apply

Fixed interest rate and payment over term. Repayment

anytime in full or part without penalty

Ideal if receiving inflow of funds soon to pay off

mortgage (e.g. receiving an inheritance or selling a house)

Rate fluctuates up or down with prime but monthly

payments are fixed. Repayment anytime in full or part

without penalty

Convert to a fixed rate mortgage anytime

Contact your OECU mortgage advisor for professional advice at 905-795-1637 or email at support@oecu.on.ca.

Contact your OECU mortgage advisor for professional advice at 905-795-1637 or email at support@oecu.on.ca.

Contact your OECU mortgage advisor for professional advice at 905-795-1637 or email at support@oecu.on.ca.